Overcoming Pessimism

If you are feeling pessimistic about the world – or know someone that is – I highly recommend Maarten Boudry’s “Seven Laws of Pessimism.” It is a powerful antidote for the dejection that comes from excessive news consumption.

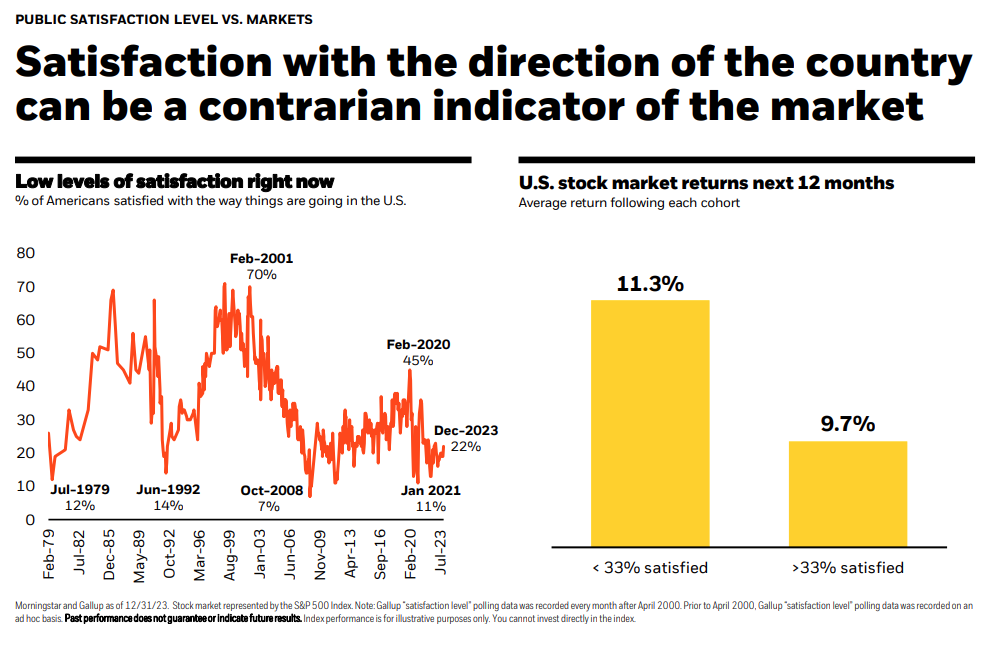

Alternatively, if your pessimism is aimed specifically at the direction of our country and the impact you feel that negative direction will have on the financial markets, well, hang on tight, because I have just the chart for you!

Source: Blackrock

What we’re looking at here is the average stock market return in the 12-months following a survey where people answered the question, “How satisfied are you with the way things are going in the US?” When the populace was collectively most dissatisfied, the stock market averaged an 11.3% return over the next 12 months. As levels of satisfaction increased, the stock market’s forward long-term return decreased.

I bring this up because pessimists will always sound smart – like independent thinkers who dare to face the frightening truths of the world while everyone else is too afraid or too stupid to see them - but historically it has been the seemingly foolish optimists that have been able to outperform by staying invested.