1st Quarter Portfolio Updates

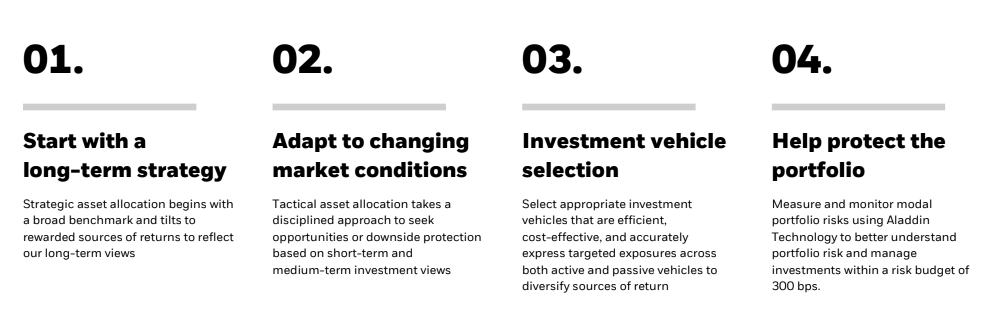

Last quarter we laid out our investment process highlighting steps one and four described in the chart below.

Today’s note will be briefer and stick to reviewing some of the trades we made last week.

Important Disclaimers:

While we may use different models for clients with different preferences and in different situations, the general ideas remain the same.

We manage risk by making small changes such that if the benchmark were to go down 10%, we would expect to be down somewhere between 7 – 13%. If the market went up 10%, we would anticipate being up 7 – 13%. If, for example, you read the trade rationale and see something that says, “This could lead to some market chop,” that does not mean, we suggest moving to cash until things get less choppy. Portfolio management is about making small changes in line with your long-term plan. Markets are always going to be choppy. Exposing the portfolio to the potential for occasional losses is the requisite cost of being exposed to the market’s long-term upside.

Now For Recent Updates

Screenshot of the % changes in our core models.

For Clients With Stock Portfolios

We remain 2% overweight to stocks with a continued bias towards US companies.

Rebalanced the growth/value factor weighting to benefit the portfolios in the event last year’s value-centric underperformers rebound.

Introduced exposure to an actively managed factor rotation ETF.

For Clients With Bond-Heavy Portfolios

We trimmed profits on the long-duration trade and reduced interest rate sensitivity.

For a full breakdown of the updates to our ETF models, here are links for the Target Allocation ETF models, the TSA Core models, and the TSA Tax-Aware models.

As always, if you have questions about this or anything else, please don’t hesitate to reach out or schedule a meeting.